If we’ve contacted you, it’s probably because we believe you’re related to someone who has died, and you could be one of a number of people entitled to share in that person’s estate.

Yeah, yeah, it’s another scam, right?

Actually, no. It’s a legitimate and very valuable service.

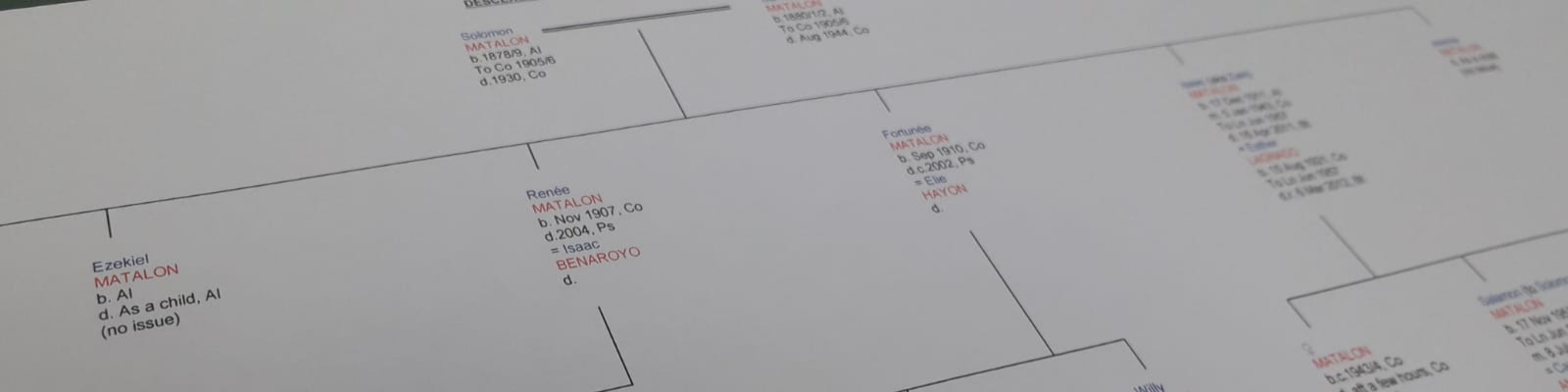

We painstakingly reconstruct the family trees of people who have died, in order to find their closest relatives and to enable their estates to be distributed to the right individuals.

Sometimes, the people we contact have never heard of their relative who has died, but in some cases it’s a close family member, like a father or a sister, with whom they’d lost touch.

Who is entitled to inherit from the deceased person?

This depends on the law of the country where the deceased died. In England and Wales, we could be looking for the deceased’s spouse, their children, their parents, their brothers and sisters, their aunts and uncles, or their cousins. Ultimately, though, the deceased’s estate is shared out among the heirs according to the applicable law.

If you have brothers or sisters, the chances are they will probably also be entitled to inherit from the same person, so we’ll be contacting them, too. This is another way to tell we’re genuine.

How do you charge for the work you do?

We work on a contingency fee basis – more commonly known as “no win, no fee”.

In return for our work in identifying your relationship to the deceased, locating you and providing information to prove your claim to the estate, we ask you to agree for us to be paid a small percentage of what you inherit.

Percentages vary depending on the type of case and the amount of research involved. Generally, the most we charge is 25%, although cases which involve the inclusion of foreign associate firms in the research can require percentages to be a little higher than this.

We will never ask you to pay any money upfront! The entire contingency fee system is designed to protect you: you never write us a cheque; we never get your bank details; you pay nothing unless you receive your inheritance.

Ok, so what happens next?

If we confirm that you’re entitled to inherit on one of our cases, we’ll ask you to sign some paperwork and return it to us:

Agreement: This document awards us our percentage, and allows us to compile your claim to the estate. Of course, you’re welcome to take legal advice before signing this, and the law allows you 14 days to change your mind after you sign, too.

Power of Attorney: We ask some (though not all) heirs to complete this form, which performs two roles. Firstly, it takes away from you the legal responsibility of distributing the estate correctly. This means you won’t have to keep signing paperwork regarding the estate, because Saul and the team will do it all for you. We’re fully protected by all the relevant professional insurances, to prevent anything going wrong. Secondly, it saves you having to make important decisions during the administration, such as which lawyers to use, how much to sell a property for or whether charges made by others to the estate are acceptable. Having said this, you’re still welcome to be as involved in the process as you wish. The Power of Attorney refers only to the deceased’s estate and doesn’t affect your other financial interests at all.

We recommend that a suitable law firm – such as those we instruct ourselves – be used for the practical administration of the estate, as this ensures that the proper expertise is used and that there is full insurance cover at all stages to protect both you and any other beneficiaries.

What else do you need from me?

We may also ask you to provide proof of your ID and your address, which helps us to prove that the people we find really are who they say they are. We usually ask for certified copies of ID documents and, if you provide your receipt, we’ll be happy to reimburse you for any money you have to spend to obtain these. We do not retain this information once the job is done, and we only share it with others when necessary.

We will only use your data for purposes relevant to your claim and do not share it with others for marketing purposes. Read our full Privacy Policy here.

How long does it all take?

For each estate, this depends on what’s involved in the administration process to release the funds and, sometimes, on which organisation or authority is in charge of the estate. From the time we solve a case until the family’s claim to the estate is admitted can be as little as three or four weeks. The case is then passed to one of our lawyers, who carries out the legal administration. This usually takes 6-12 months, after which they can distribute the estate: that is, they can pay the heirs and pay us.

We don’t get paid until you do, so it’s in our interests to find all the heirs as quickly as possible and then co-operate with the administrating lawyer efficiently to avoid delays.

There is a legal time limit (“statute of limitations”) for claims to estates in England and Wales, which is 30 years from the date when the deceased died. If someone’s estate goes unclaimed for 30 years, it passes to the Crown.

What do you mean by “the deceased’s estate”?

Sadly, this doesn’t (usually) mean a stately home in beautiful gardens! A person’s estate is simply anything that they owned at the time of their death. This can include bank or building society accounts, savings, investments and, of course, property, in terms of both individual objects (“personal effects”) and premises, such as the house or flat where they lived, if they owned it.

How much are estates typically worth?

It’s very rare that we know how much an estate is worth when we’re doing the initial bulk of the research on a case. This is very frustrating for us because, in most cases, we genuinely have no idea if we’re going to cover our costs on any case we work!

Usually, though, most estates turn out to be in the region of between £2,000 and £50,000. There are higher value estates, such as where the deceased owned property, and there are lower value ones, often consisting of just one small bank account.

The approximate value of the estate is often not known until a few weeks into the administration process, and the exact value may not be known for some months after that. As soon as we have a reliable approximation of value, we’ll let you know.

What happens if the deceased had debts?

The legal administration process involves collecting in all the deceased’s assets and paying any debts (“liabilities”) that he or she had, along with various other costs, such as the lawyer’s fees and other expenses. In almost every case, this leaves an amount left over to be distributed to the heirs (“the residue”).

But, very occasionally, the deceased’s debts are more than their assets: effectively, the estate is bankrupt (“insolvent”). In these cases, all the money in the estate is used to pay off as much of the debt as possible, with the rest of the debt simply being written off.

Don’t worry: you will never be required to pay anything towards the deceased’s debts!

Will I be taxed on my inheritance?

Quite simply, no. If the estate is large enough to attract Inheritance Tax, this will be paid from the estate as part of the administration process. The inheritance which you receive is entirely tax-free!

What if the deceased left a will?

It does sometimes happen that, in the course of our research and the legal administration, it turns out that the deceased left a will after all. As long as the will is an original and it’s valid, it takes priority over all the research we’ve done.

Aren’t there other companies who do this work?

Yes. Probate genealogy is a very competitive field and the chances are you’ll be contacted by several other genealogy companies at the same time. So why should you choose us and not them? Find out here!

If you have any other questions not covered on this page, feel free to get in touch here.